Wines from the Rhone Valley and Barolo may be the best option for wine investments right now. Below we outline 5 reasons you should invest in these today.

- Surging Demand and Appreciation for Barolo:

- Rhone's Global Recognition and Consistent Performance:

- Barolo's Limited and Stringent Production:

- Rhone's Diversity Offering Multiple Investment Entry Points:

- Impressive Aging Potential Boosting Long-Term Value:

Statistic: Over the past decade, Barolo has seen consistent year-over-year price appreciation. For instance, according to the Liv-ex market data, top Barolo wines, like those from Giacomo Conterno or Bruno Giacosa, have seen their values multiply, with some vintages appreciating by over 100% in a span of just 5 years.

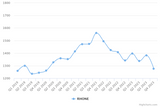

Statistic: The Rhone Valley's top wines, especially from Chateauneuf-du-Pape and Cote-Rotie, have consistently outperformed the Liv-ex Rhone 500 Index. In particular, between 2010 and 2020, the index itself rose by approximately 35%, with select wines achieving even greater growth.

Statistic: Barolo's production is capped by both geography and stringent regulations. Only about 14 million bottles are produced annually, a relatively modest figure when considering the global demand. This inherent limitation has a direct impact on its price and value trajectory.

Statistic: The Rhone Valley comprises over 5,000 wine-producing estates. In 2019, it produced around 3.6 million hectoliters of wine, with a value range catering to both the modest collector and the high-end investor. This means an investor has flexibility in strategy, whether targeting the more affordable yet promising wines or the established and pricier classics.

Statistic: According to wine experts, a quality Barolo can be aged for 20-30 years, often reaching its peak after several decades. Similarly, a study published in the "Journal of Wine Economics" highlighted that Rhone's best wines, particularly from top vintages, can not only age for decades but can also see their market values multiply over this period.

The combination of limited production, consistent quality, rising global demand, and impressive aging potential backed by solid data makes both Barolo and Rhone wines compelling investment avenues for those looking to diversify their portfolios or simply appreciate the value of fine wines.